Decrease in Home Buy Credits and Home loan Renegotiating Rates: An Outline of Latest things

With contract rates reliably declining, numerous property holders are hoping to renegotiate their advances. The Home loan Financiers Affiliation (MBA) detailed a 8 percent expansion in renegotiate applications last week, denoting the fourth sequential seven day stretch of falling rates. The MBA demonstrated that all out contract applications, including renegotiating, rose by 2.4 percent contrasted with the earlier week. The 30-year fixed-rate contract arrived at its absolute bottom since January 2018, dropping from 4.4 percent. Joel Kan, the MBA's Partner VP of Monetary and Industry Estimating, commented that the normal size of renegotiate advances expanded as borrowers with bigger equilibriums benefited from the lower rates.

Alternately, homebuyer reactions to the decreased rates have not been as positive. Applications for home buys declined by 2% soon. The Public Relationship of Real estate agents detailed a 0.4 percent decline in existing home deals last month, demonstrating a second sequential decrease in deals throughout the spring season. Kan noticed that while buy movement fell, it remained around 7% higher than the earlier year. This present circumstance might be impacted by progressing worldwide exchange debates, which have presented vulnerability and impacted generally request. Kan suggested that a few potential purchasers could defer their home quests until there is greater dependability on the lookout.

Moreover, the shortage of reasonable section level homes has prompted expanded costs, delivering them less available for some purchasers. The portion of ensured contract applications through the Government Lodging Organization dropped to 9.4 percent from the earlier week's 10.1 percent.

Alternately, homebuyer reactions to the decreased rates have not been as positive. Applications for home buys declined by 2% soon. The Public Relationship of Real estate agents detailed a 0.4 percent decline in existing home deals last month, demonstrating a second sequential decrease in deals throughout the spring season. Kan noticed that while buy movement fell, it remained around 7% higher than the earlier year. This present circumstance might be impacted by progressing worldwide exchange debates, which have presented vulnerability and impacted generally request. Kan suggested that a few potential purchasers could defer their home quests until there is greater dependability on the lookout.

Moreover, the shortage of reasonable section level homes has prompted expanded costs, delivering them less available for some purchasers. The portion of ensured contract applications through the Government Lodging Organization dropped to 9.4 percent from the earlier week's 10.1 percent.

LATEST POSTS

- 1

EU health regulator urges immediate vaccinations amid early surge in flu cases

EU health regulator urges immediate vaccinations amid early surge in flu cases - 2

Mobility exercises are an important part of fitness as we age. Here are some tips

Mobility exercises are an important part of fitness as we age. Here are some tips - 3

Congo declares its latest Ebola outbreak over, after 43 deaths

Congo declares its latest Ebola outbreak over, after 43 deaths - 4

Step by step instructions to Buy a Jeep Wrangler on a Senior's Spending plan

Step by step instructions to Buy a Jeep Wrangler on a Senior's Spending plan - 5

Atorvastatin recall may affect hundreds of thousands of patients – and reflects FDA’s troubles inspecting medicines manufactured overseas

Atorvastatin recall may affect hundreds of thousands of patients – and reflects FDA’s troubles inspecting medicines manufactured overseas

Share this article

Instructions to Amplify Certifiable Experience While Chasing after an Internet Advertising Degree

Instructions to Amplify Certifiable Experience While Chasing after an Internet Advertising Degree Figure out How to Improve Your Stream Voyage with Remarkable Trips and Exercises

Figure out How to Improve Your Stream Voyage with Remarkable Trips and Exercises Manual for Savvy Home Lighting Framework: Lights up Your Space

Manual for Savvy Home Lighting Framework: Lights up Your Space Joshua Made Last-Second Seat Change That Saved His Life

Joshua Made Last-Second Seat Change That Saved His Life Embrace Effortlessness: Moderation and Cleaning up Tips

Embrace Effortlessness: Moderation and Cleaning up Tips They died 'doing what they loved': The stories of workers in their 80s who died on the job

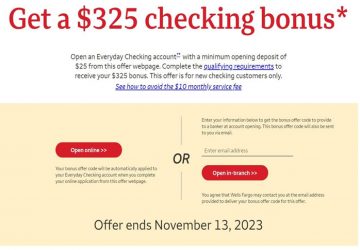

They died 'doing what they loved': The stories of workers in their 80s who died on the job Figure out How to Score Huge with Open Record Rewards

Figure out How to Score Huge with Open Record Rewards Tyler Childers' 'Snipe Hunt' 2026 Tour: How to get tickets, presale times, prices and more

Tyler Childers' 'Snipe Hunt' 2026 Tour: How to get tickets, presale times, prices and more The 10 Most Significant Virtual Entertainment Missions

The 10 Most Significant Virtual Entertainment Missions